The impact of carbon neutrality on the investment performance: Evidence from the equity mutual funds in BRICS - ScienceDirect

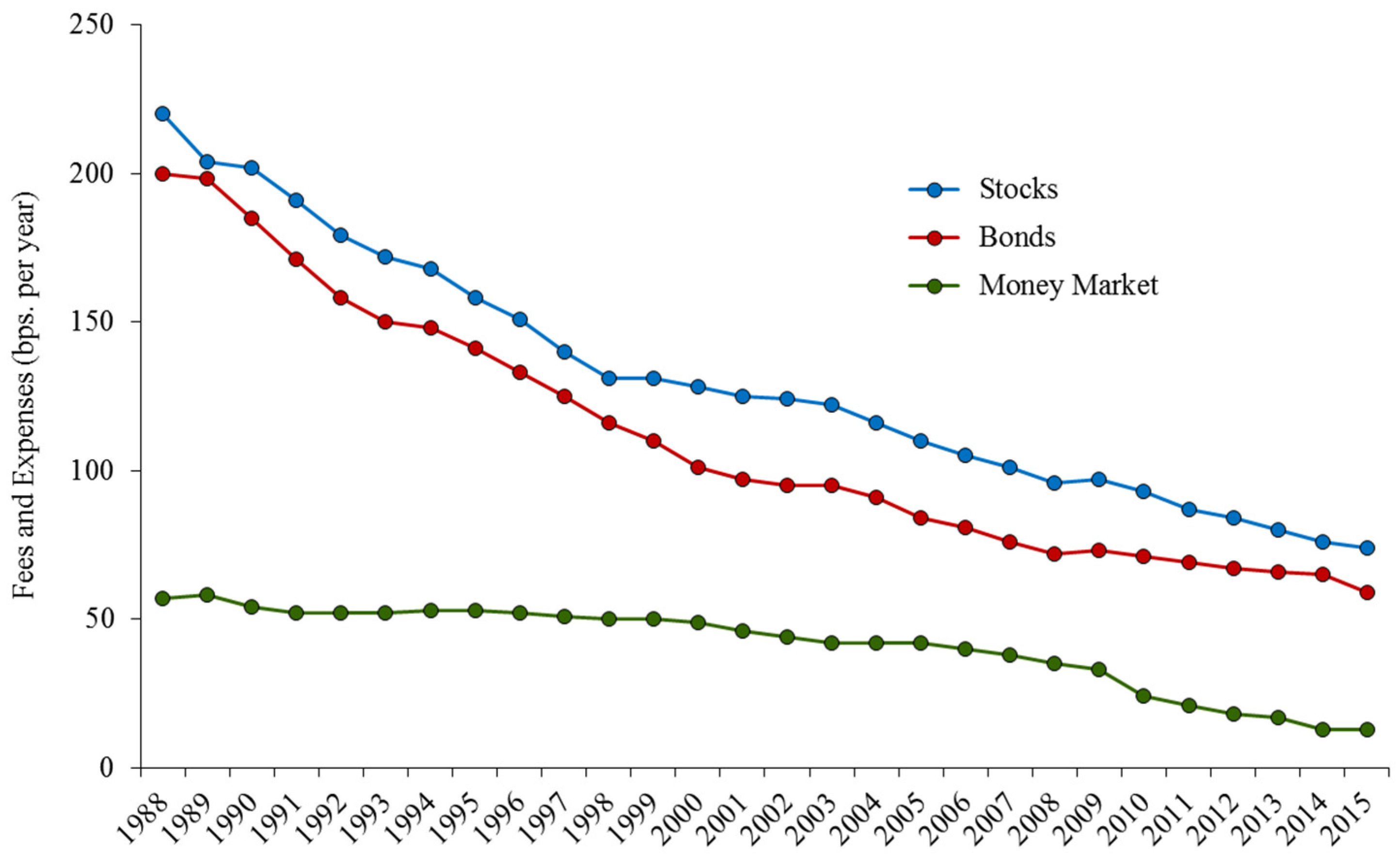

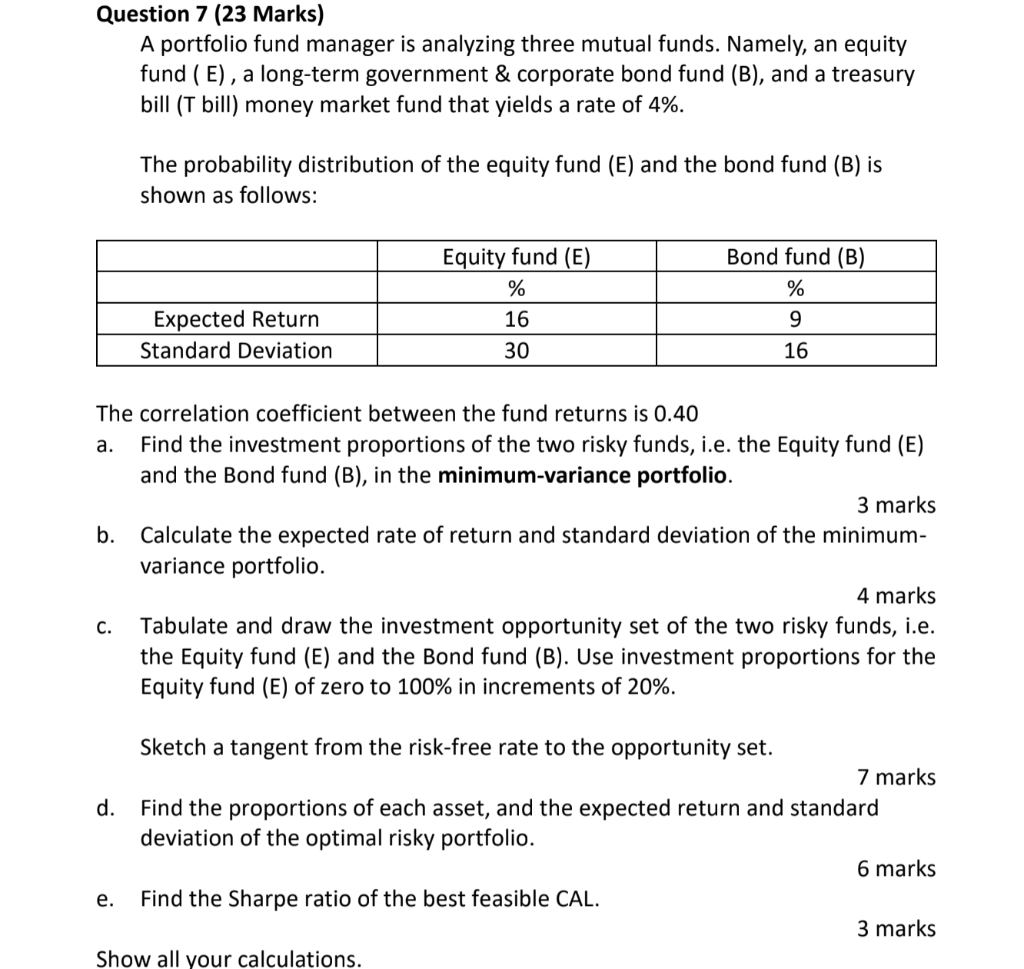

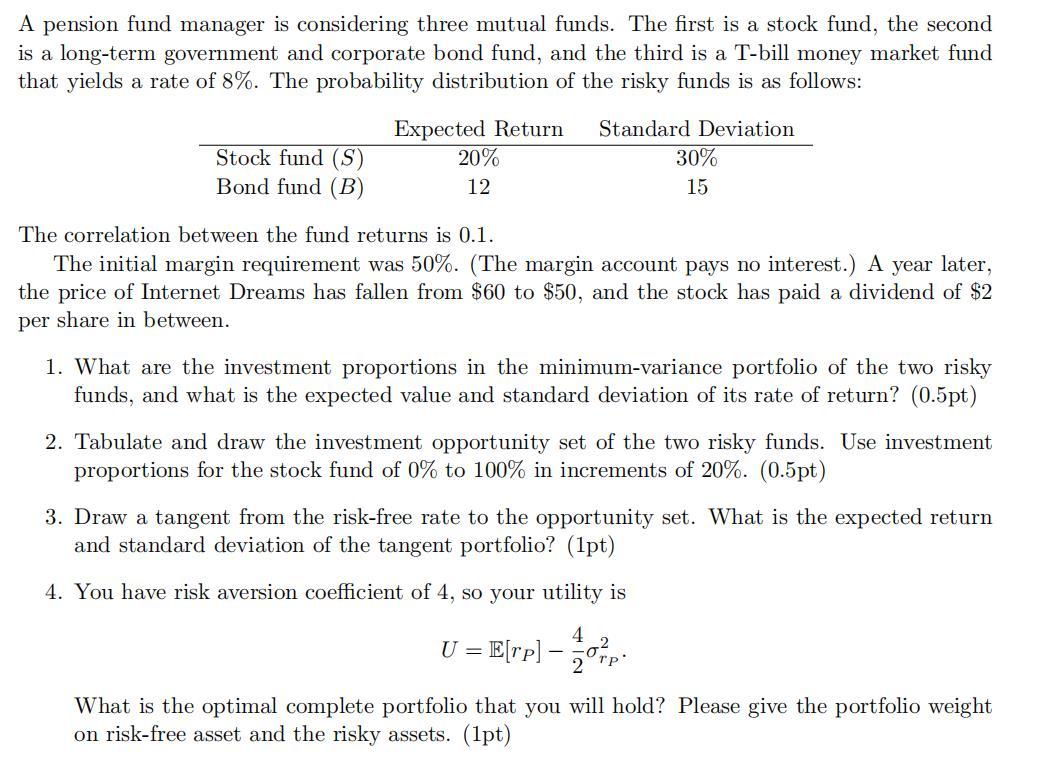

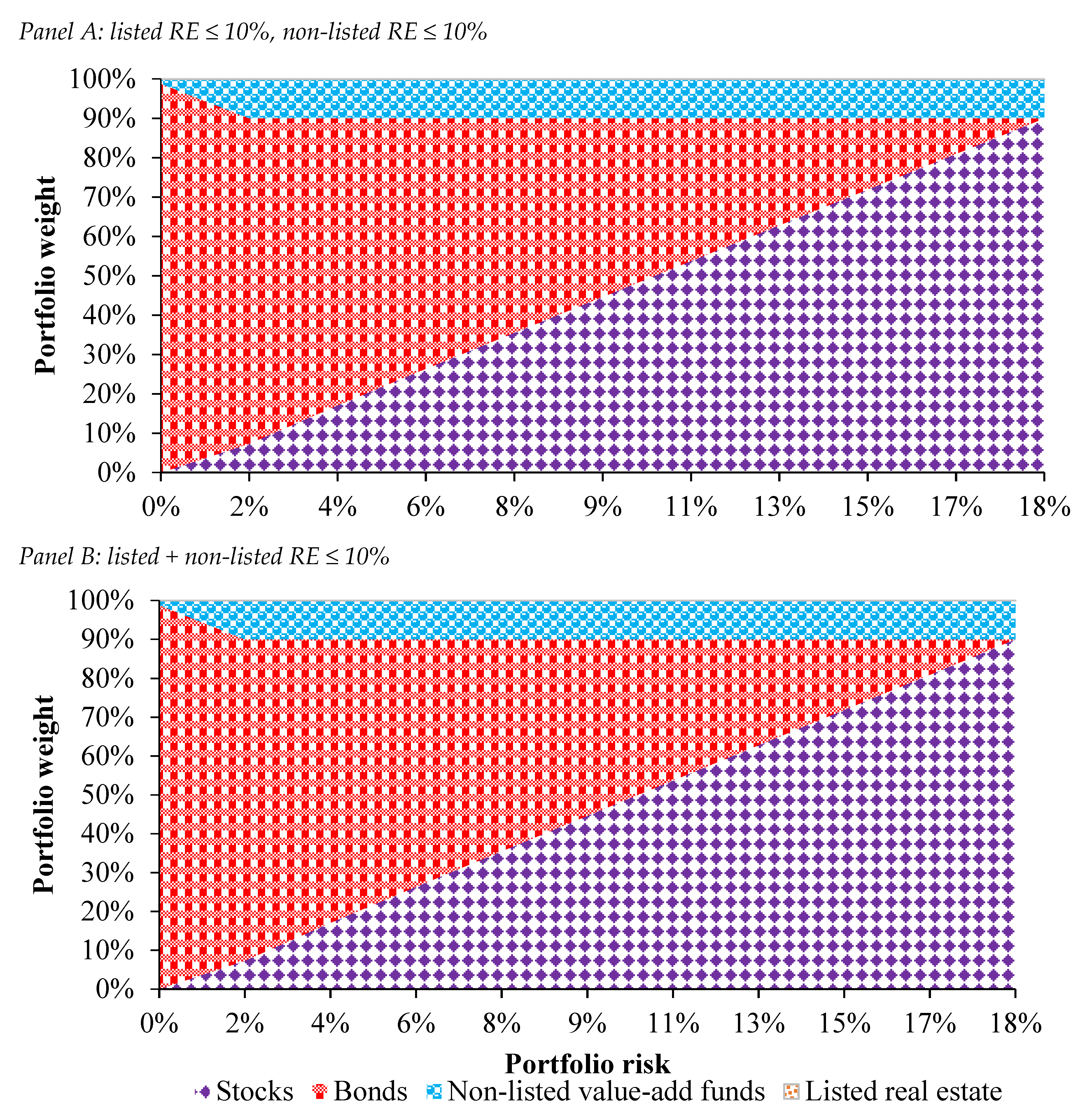

JRFM | Free Full-Text | The Performance and Diversification Potential of Non-Listed Value-Add Real Estate Funds in Japan

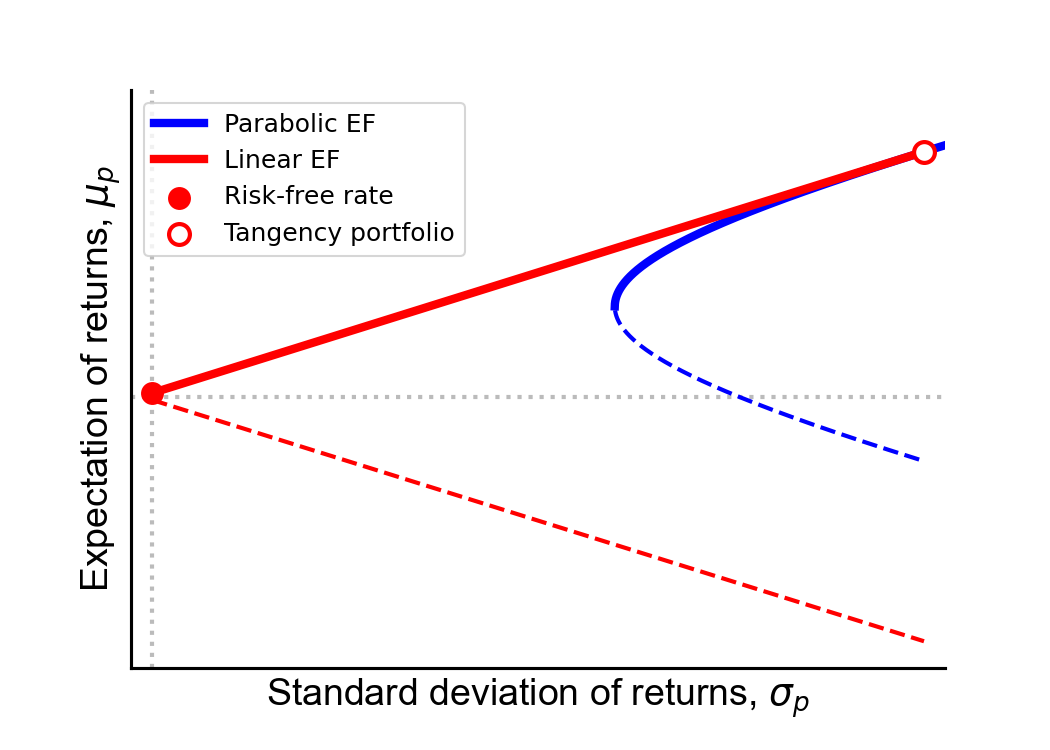

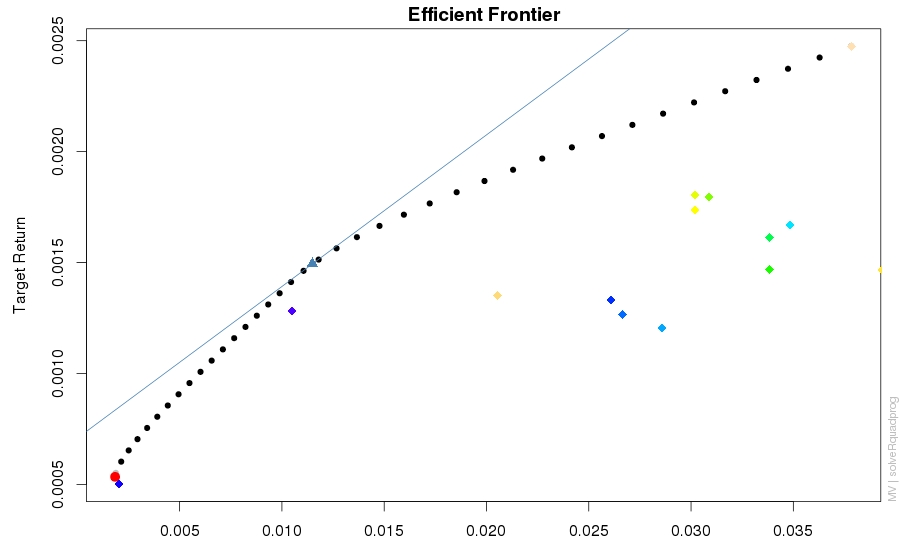

Automating Portfolio Optimization and Allocation using Python | by Sanket Karve | Towards Data Science

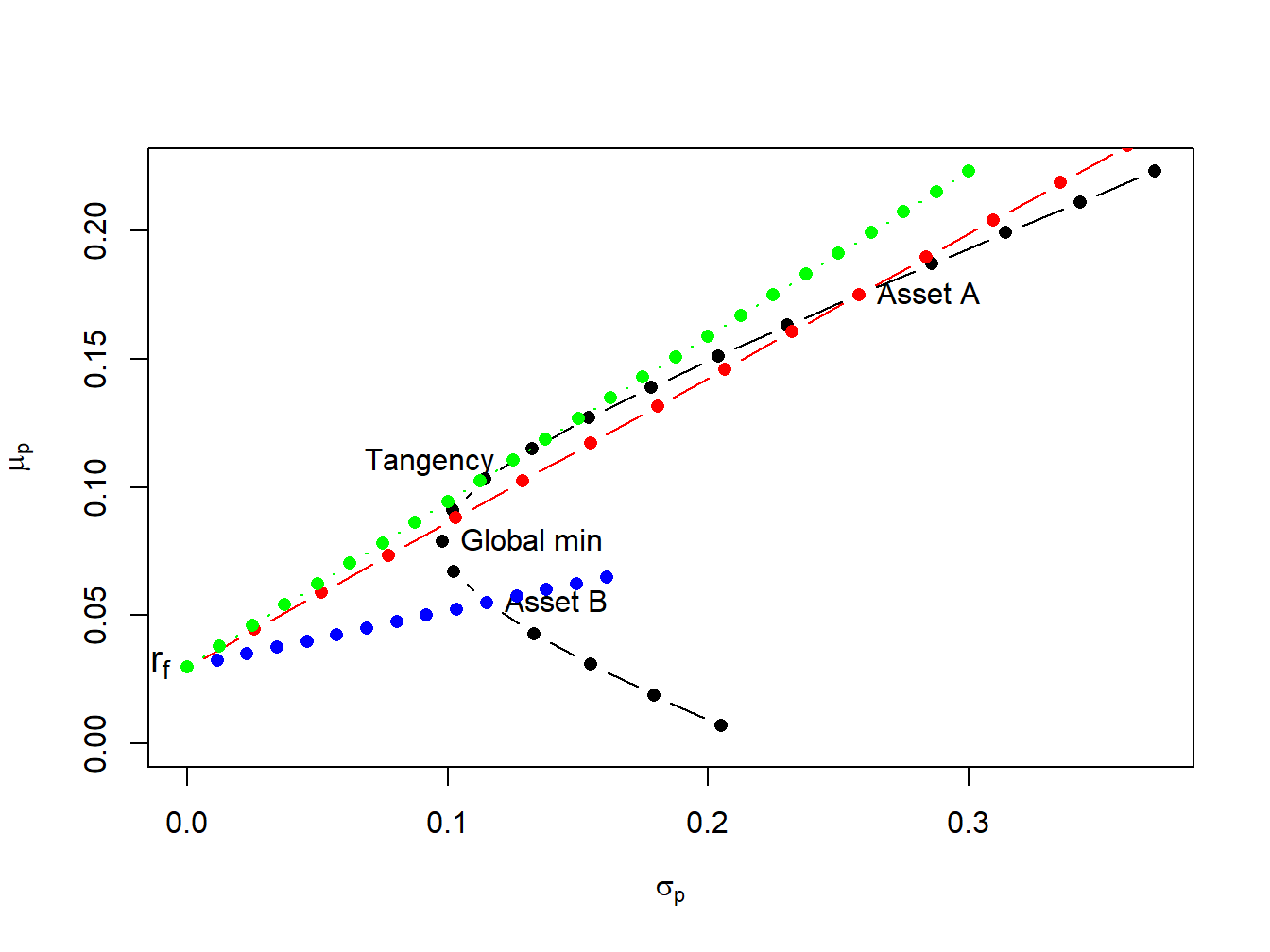

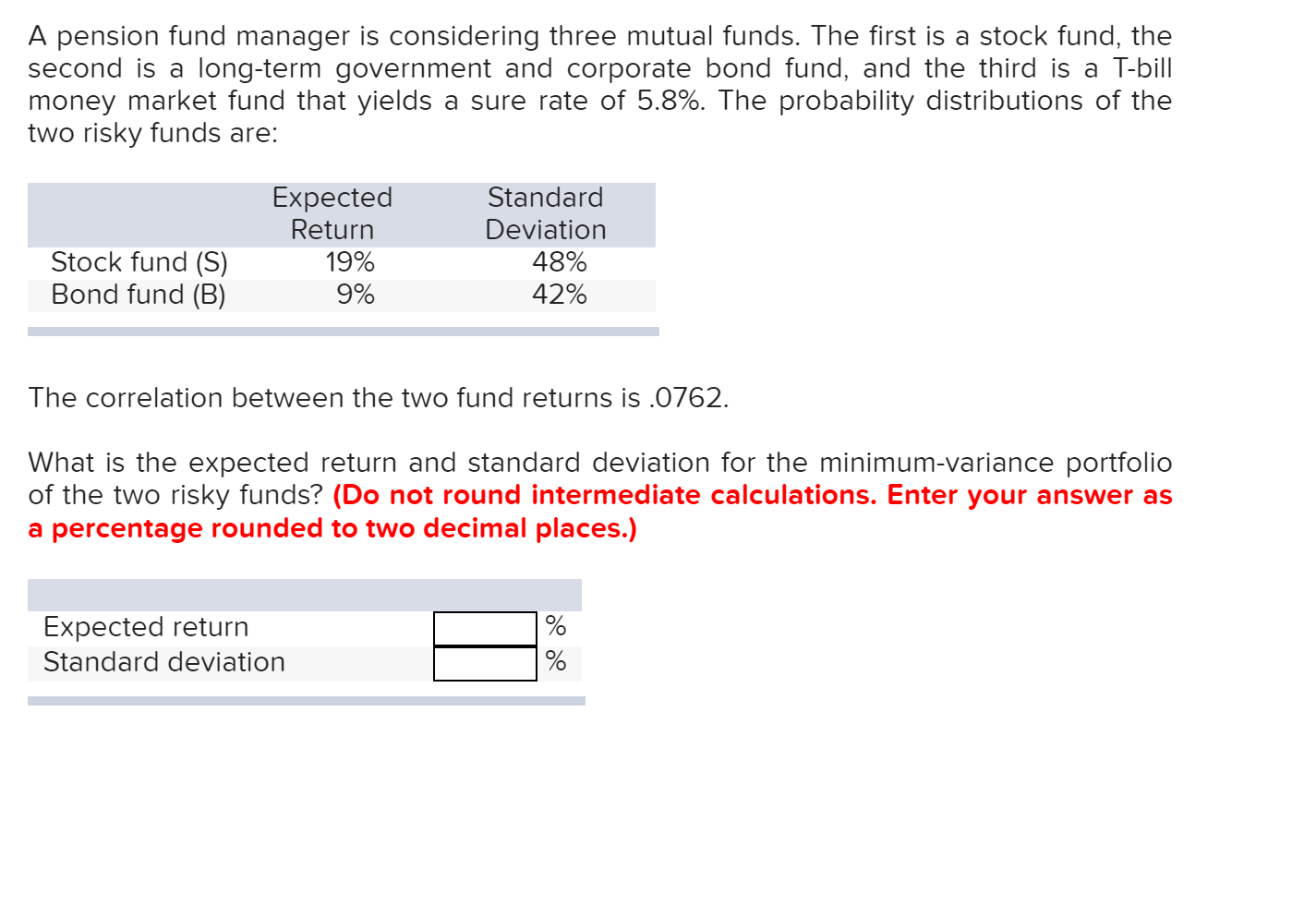

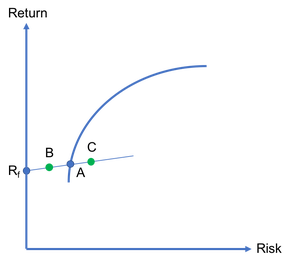

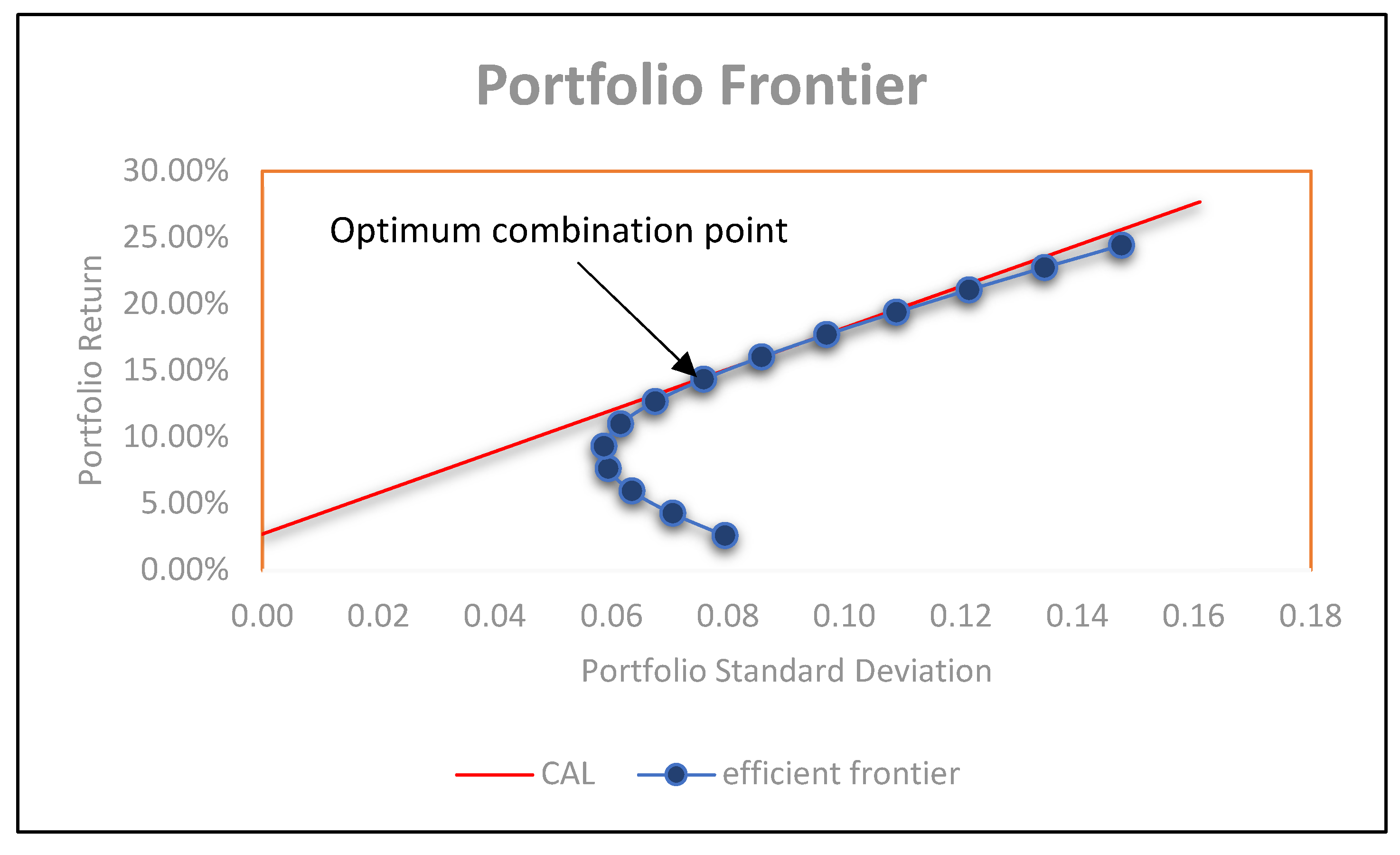

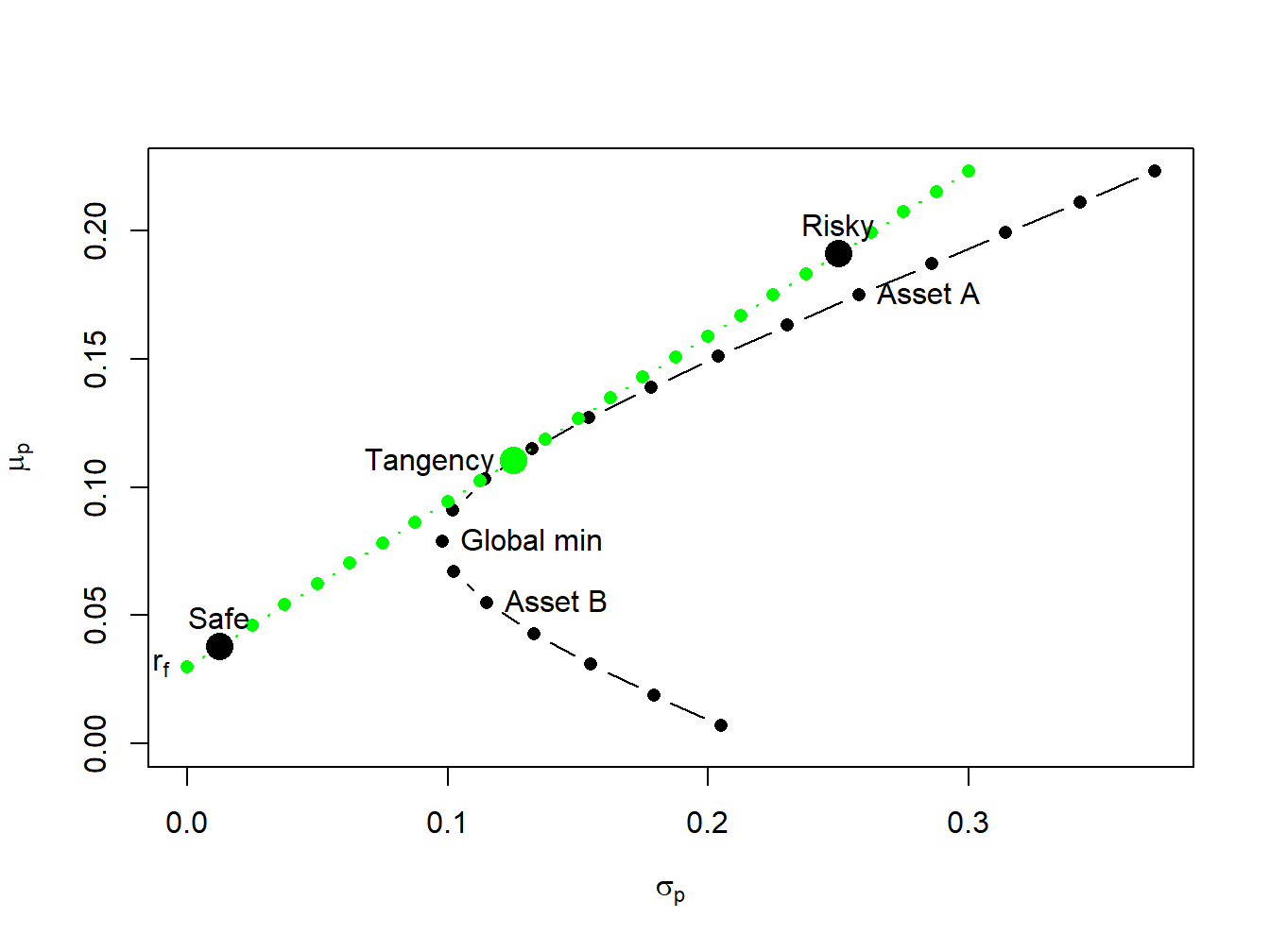

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R

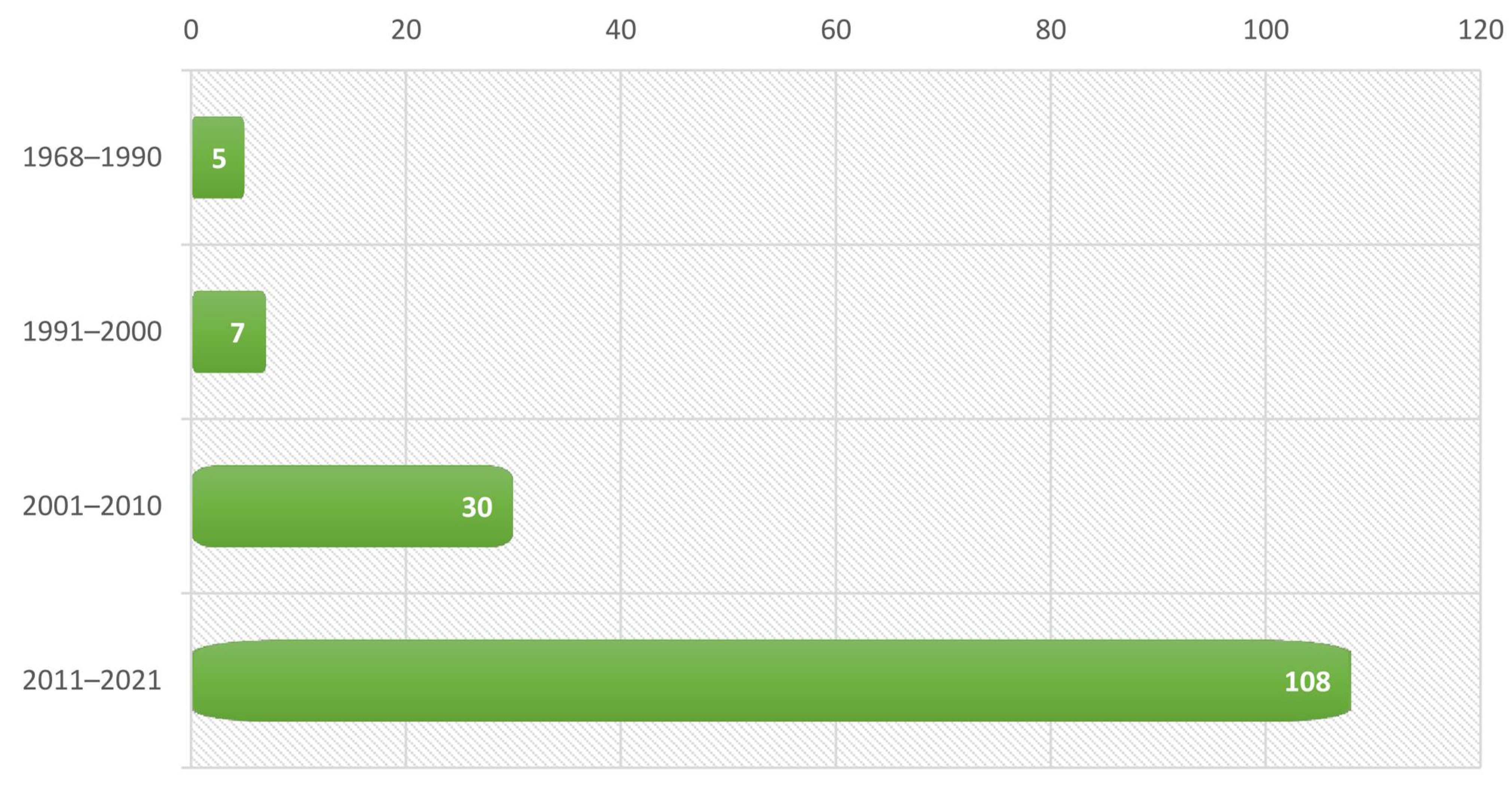

JRFM | Free Full-Text | How Many Stocks Are Sufficient for Equity Portfolio Diversification? A Review of the Literature

NATIONWIDE MUTUAL FUNDS - Nationwide Multi-Cap Portfolio Class R6 - Portfolio Holdings, AUM (13F, 13G)

Be Opportunistic: Tips On Transitioning To Tax-Managed Investing From A Legacy Mutual Fund Portfolio | Russell Investments